What Credit Score Is Needed for A Home Loan?

Your credit score is essential when buying a home.

You have probably heard that you’ll never get a home if you don’t have perfect credit.

Be that as it may…

The good news is… that’s not necessarily true.

Bad things happen in life to everyone, and sometimes that can lower your credit score.

However, there are loan programs available for less-than-perfect scores.

On the other hand…

A higher score can help you find the best home loan for you and your family.

We have compiled a list of programs and services to help you achieve the best terms and interest rate for your needs.

Most importantly…

If you’re considering buying a home, we can help you get your credit score and see how much you qualify for a loan.

For starters…

Three major bureaus, Experian, Equifax, and TransUnion, keep track of your credit history. When lenders pull your credit report, your information is given to them so they can approve your loan.

But, before we go into how your credit score is determined…

First, we’ll look at what scores you need to qualify for the different types of loans.

Let Us Help You With Your New Home

All Home Loan Programs Offer Different Minimums

For the most part people have average scores in the high 600s to 700s. Those who have ratings in the upper 700s are excellent ratings.

Your score determines the interest rate and the type of loan you can qualify for right now.

Here are the minimum credit scores that lenders require.

Conventional Loans: 620

Credit Score: You need at least a 620 score for a conventional loan. When you apply for a loan, the lender will check your credit history to see if you qualify.

Amount of Loan: Your conventional loan must meet specifications set by Freddie Mac and Fannie Mae as to how much you qualify for your loan.

Debt-to-Income Ratio: Your debt-to-income ratio represents how much of your monthly income goes towards your debts. You can calculate your DTI by adding up your monthly payments and dividing it by your gross monthly income. Your DTI must be 50% or lower.

VA Loans: 580

Benefits: The VA Loan benefits those who have served in the military and are only available to veterans, active duty service members, and surviving spouses.

Zero Down: Even though there is no down payment with a VA loan, you’ll have to pay a funding fee.

Primary Residence Only: You cannot use a VA loan to buy a vacation home or a second home.

FHA Loans: 500

Very Flexible: If your score is in the 500 range, you’ll have a better chance of getting approved through the FHA (Federal Housing Administration.)

Terms: Down payments as low as 3.5% with a FICO score of 580 or better. If you score 500 to 579, you’ll pay a 10% down payment.

Jumbo Loans: 700

Requirements: If you need a loan larger than the conforming loan limit, you’ll need a credit score of around 700 or higher and have solid financials, and a strong credit score.

Get the Best Rates: With a rating of 740 or higher for a jumbo loan, you usually get the best mortgage rates. A smaller interest rate can make a big difference in your monthly payments.

What Happens If You Don’t Have Enough Credit Score to Buy a Home?

You might qualify for a mortgage loan with a lower credit score if you have bad credit. But you’ll more than likely have to pay more for your loan.

In general…

A good rule of thumb is to have a credit rating of at least 680.

This is because if you score below that number, lenders may require you to pay more than you would typically pay for your loan.

How Is Your Credit Score Determined?

Your credit score is a three-digit number indicating your creditworthiness to lenders.

This number ranges from 300 to 850.

Given these points…

The higher the number, the better.

A score of 740 or above is considered excellent credit.

Most importantly…

Your Payment History, which reflects how well you pay back the money you borrow, is a major factor in determining your credit score.

When you take out a loan or buy something on credit, the Credit Bureaus will keep track of your payment history. They also record how many payments you’ve missed and note when you pay your loan off.

In case…

If you miss any payments, you’ll have a negative effect on your credit score. In addition, if you are in default, lenders will report it to the major credit bureaus.

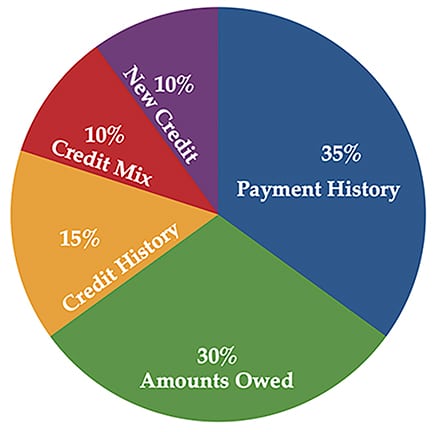

These are the five key factors that make up your credit score.

1) Payment History – 35%

The Lender wants to see how you pay your bills.

2) Amounts Owed – 30%

This is the amount you owe all of your creditors.

3) Credit History – 15%

This number reflects your long term past credit.

4) Credit Mix – 10%

How many credit cards, mortgage, cars… etc.

5) New Credit – 10%

What new credit you’ve opened recently.

Don’t Give Up…

You do have other options if your score isn’t high enough. If you know someone with a higher rating, who would co-sign, that will help you secure your loan and purchase your home.

Another option would be to have a family member or friend buy the home and put you on the title; then, you could refinance in your name when your credit improves.

On the other hand…

If this doesn’t work, your next best option would be to improve your credit.

Rebuild Your Credit Score to Purchase Your Home

If you find yourself in a position where you can’t qualify for a home, create a plan to increase your credit rating to qualify.

To begin with, here are some steps you can take to increase your credit score.

- Pay all your bills on time: This is the number one thing you can do that will raise your credit score.

- Credit Cards: Don’t close any of your credit cards; keep them open, make small charges, and pay them off monthly.

- Applying for new credit: Don’t be applying for new credit now. Remember, you are building your financial picture up to buy your home.

- Credit Reports: Check your credit report and make sure everything is accurate on the report. If you find an error has been reported, by all means, contact the credit bureau and get it removed.

- Credit Card Balances: Work on paying off your old balances and keep your balances low. This is the second most significant factor in your score.

Monitor Your Progress and Watch Your Credit Score Soar

Most importantly, you can’t afford to take a mortgage payment risk that could negatively impact your credit score.

The best way to avoid this is to get pre-qualified before you start shopping.

In addition, there are several ways to build a positive credit history.

For example, you can do it by paying your bills on time, not exceeding your limits, and only opening new accounts when necessary.

As I have noted…

Paying your bills on time is the number one thing you can do to raise your credit score.

It’s important to know that the number of your score represents a picture of your entire financial situation.

It’s how you handle your debt and whether you can pay back what you owe.

FAQ: Our Customers Want to Know…

What credit score is needed to buy a house with no money down?

You’ll usually need a 640 credit score to get a home with no money down. However, you can apply for a loan with the USDA loan program if you have a low credit score.

The USDA loan is a government program that allows people with poor or bad credit to purchase a home with no money down. To qualify for this loan, you must be a first-time homebuyer with a credit score of at least 640.

Our programs can help you meet your needs and budget; we offer services with consultants who know the mortgage business. We’re here to help you and can advise you on the best type of loan program for your situation.

What is the minimum down payment in Colorado?

It depends on what kind of mortgage you get. If you’re looking at the USDA- and VA-backed mortgages, they don’t require a down payment. Conventional loans require as little as 3% down, and FHA mortgages require 3.5%.

Some Colorado programs require a payment of $1,000 with a traditional loan.

To begin with…

The amount of money you need to put down as a down payment for a house depends on which loan program you choose and how much you are borrowing.

We’ve all heard the expression, “You can’t put a price on love.” It’s true! But what if you could put a dollar amount on the happiness a home brings you and your family?

Things to consider…

The mortgage industry is a highly complex business. There are many different programs available to help you. Contact us today, and we can help you find the best program.

Can you get a mortgage loan with a 600 credit score?

The good news is, yes. It’s possible to get a mortgage loan with a 600 credit score. However, there are restrictions. For instance, the lender will check your debt-to-income ratio (DTI) and verify employment. For example, your DTI should be no more than 40 percent of your gross monthly income.

The lender will look at your credit history.

You’ll also pay higher mortgage insurance premiums if you have a low score.

With a low score, there are several mortgage options.

Your options include VA loans and FHA loans designed to help people with low credit scores.

The first thing to do is…

Contact one of our mortgage brokers, and we’ll help you find the perfect program. We take all the confusion and stress out of the mortgage business.

Are You Ready to Get Your Pre-approval?

We’ll help you get the right mortgage for you and your family with payments to fit your budget.

Now keep in mind…

Having a plan and following it will move you closer to your goal of home ownership.

At JFR Home Loans, we help make your dreams come true.

However, if you find yourself with lower credit, remember it isn’t the end of your dream of owning a home.

Read these facts carefully…

- We offer pre-approval for your mortgage loan.

- You have access to top-of-the-line mortgage programs to help you afford your home.

- We offer programs to help you get a home loan.

- You can save money on your mortgage… on an average of $9,000 over the life of your loan.

With this in mind…

The best thing you can do is contact us and find out what you qualify for.

If you have bad credit, don’t worry.

We can help you.

Imagine what it would be like to move into your new home.

If you have any other questions, Contact Us, or call 303-761-8045, and we’ll be more than happy to answer your questions.

Don’t miss a word of this…

P.S. You are ready for your new home, aren’t you?

I’m sure you’ve been thinking about this for some time.

Now, it’s your turn to take action and get your dream home.

Seriously…

You’re in good hands with our team. We have you covered from start to finish.

Take advantage of our years of experience so you can sit back and relax.

We look forward to working with you.

Get pre-approved for your new home today.

You May Also Like...

FHA Loans in Colorado: Unlocking the Path to Homeownership

FHA Loans in Colorado: Unlocking the Path to HomeownershipHere’s why FHA...

Colorado FHA Loans: Easy and Stress-free Programs

Colorado FHA Loans: Easy and Stress-Free ProgramsAre you familiar with...

Find the Best Colorado Mortgage Programs

How to Find the Best Colorado Mortgage ProgramsColorado mortgage programs...