Benefits of 15-year and 30-year Mortgages: See Which One Is Best for You

Are you looking at the 15-year and 30-year mortgages and wondering which one is right for you?

If you’re looking at mortgages and buying a home, you’ve come to the right place.

What’s more…

We’re going to look at the benefits and drawbacks of both programs.

The majority of homeowners go with a 30-year fixed-rate mortgage because it gives them a smaller monthly payment and more time to pay off their house.

The main difference between a 15-year and a 30-year mortgage is that after 15-years, you won’t have any more house payments.

And the 15-year mortgage saves you a ton of interest.

However…

On the downside, a 15 year mortgage increases your monthly payment substantially.

In general…

A 30-year mortgage is way more expensive.

But, it does lower your monthly payment.

There are advantages to both programs. It comes down to what is going to serve your needs and goals.

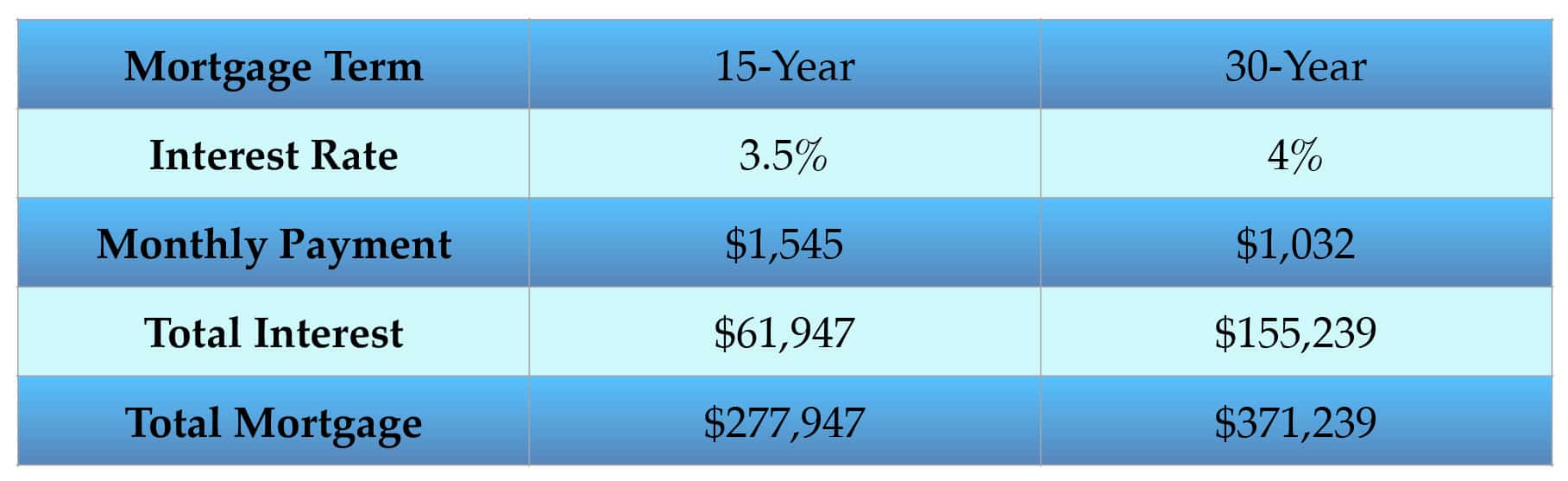

Comparison Between 15-Year and 30-Year Mortgages in Colorado

If you are looking to purchase a home in the Colorado area, you may qualify for a home loan with a lower interest rate than if you were buying in another state.

For example…

We’ll look at a $275,000 home and figure a 20% down payment ($54,000). You’ll need a mortgage for the balance in the amount of $216,000.

In the following example you can see what your expenses would be on a $216,000 home loan for either a 15-year or 30-year mortgage.

These number are for illustration only and no way would reflect your exact payments and terms.

Monthly Payments

With this scenario the 15-year mortgage at a 3.5% rate your monthly payment is $1,545 with principal and interest.

On the other hand, a 30-year mortgage on the same loan amount including principal and interest at a 4% rate would come to $1,032 per month. That’s $513 per month less than a 15-year mortgage.

Of course, your credit score, interest rate, and downpayment can affect your exact payment amount.

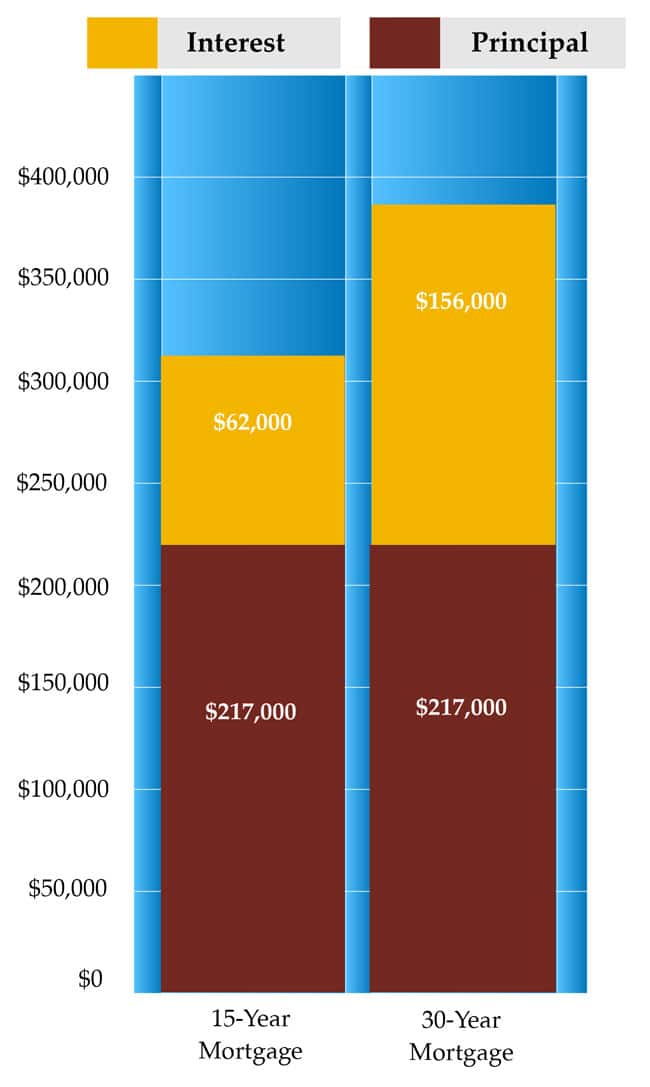

Long-term Loan Costs

As you can see on the chart the 30-year mortgage has you paying over $94,000 more in interest than the 15-year mortgage.

The good news is that with the 15-year mortgage your home is paid off in 15-years.

How cool is that?

No more house payments.

And you saved $94,000 in interest.

Lower Payment With 30-year Mortgage

Having a 30-year mortgage with a lower payment gives a lot of families more flexibility with their monthly budget.

As a result, they have extra cash for education costs, home improvements, and family expenses.

In fact…

The lower payments also make it easier to afford a home or purchase a larger home and stay within your budget.

Most importantly…

There are no prepayment penalties on mortgages here in the U.S.

So if you choose to pay your loan off early, you can without any penalties.

You can pay extra money toward the principal balance each month if you’d like to pay your loan off quicker and save interest.

What Are the Advantages of a 15-year Mortgage vs a 30-year Mortgage?

15-Year Term

- Lower Interest Rate – Usually, a 15-year mortgage has a lower interest rate than a 30-year mortgage. This way, you pay less interest over the life of the loan.

- Accelerated Mortgage Payoff Term – A structured 15-year time frame means you pay off your debt more quickly and build equity faster.

30-Year Term

- Lower Monthly Payments – Lower payments are one of the main reasons homeowners choose a 30-year mortgage. The lower payments offer more flexibility with your monthly budget. It leaves you with more cash for things like retirement, investing, renovations, and those unexpected emergencies.

Why do Homeowners Choose a 15-year Mortgage?

Here are the main reasons homeowners choose a 15-year mortgage over a 30-year mortgage.

- Payoff your debt faster and build equity more quickly.

- Free up funds for retirement. Imagine what you can do with all that extra money once your home is paid off.

- Usually the interest rate is lower on a 15-year mortgage than a 30-year.

15-year mortgages are popular with homeowners who are refinancing their original mortgage. Refinancing your home to get a better interest rate and terms is a smart way to save money on your mortgage.

Why do Homeowners Choose a 30-year Mortgage?

Having a 30-year mortgage with a lower payment gives a lot of families more flexibility with their monthly budget. They have extra cash for education costs, home improvements, and family expenses.

The lower payments also make it easier to afford a home or you can purchase a larger home and still stay in your budget.

There are no prepayment penalty’s on mortgages here in the U.S. This means you can pay extra money toward the principal balance each month if you’d like to pay your loan off quicker and save interest.

Is it Better to Get a 30-year Mortgage and Pay it Off in 15-years?

We all have good intentions… and then we end up getting side tracked.

Some people will get a 30-year mortgage, thinking they will pay it off in 15 years.

Of course…

This rarely happens because life happens instead.

That extra money you would put on the principal went towards remodeling your kitchen, new clothes, or a nice vacation.

There seems to always be something else for the use of that money.

There is no advantage to getting a 30-year mortgage instead of a 15-year mortgage in the first place. When you get a 15-year mortgage, you’re already used to the higher payment.

“I will forever believe that buying a home is a great investment. Why? Because you can’t live in a stock certificate. You can’t live in a mutual fund.”

~Oprah Winfrey

Get Help Choosing the Right Mortgage for You in Colorado

When you are looking at getting a mortgage, you’ll want to consider your age, savings, monthly budget, earnings, and financial goals.

You want to make sure that you can afford the mortgage payments you are considering.

Whether you are a first-time homebuyer or a refinancing homeowner, the 15 and 30-year mortgage loan programs are worth exploring.

Discover the Benefits of Whether a 15-year or 30-year Mortgage Serves You Best

Let’s talk today about getting you into your new home.

Now there’s even a better way to get your mortgage…

U.S.News had this to say about mortgage brokers, “A mortgage broker can help if you want support sifting through loan options, pinpointing the best interest rates, or overcoming complex borrowing challenges.” They also commented that, “A mortgage broker acts as a matchmaker to connect you with the right lender for your needs.”

In addition…

We’ll handle everything for you and get the best terms and rates possible.

In other words…

You have nothing to worry about.

Here’s what I mean…

You’ll be surprised to learn that most people are apprehensive about applying for a home loan.

Stay with me now…

Are you feeling confused, frustrated, or fearful about getting a loan and purchasing a home?

What you’re feeling is perfectly normal.

It’s easier than you think to get your mortgage…

Here’s all you have to do…

Contact Us, or call 303-761-8045 and we’ll be more than happy to answer your questions about homeownership and getting a mortgage that meets your needs and fits your budget.

P.S. If you have any questions or would like more information be sure and give us a call at 303-761-8045 today.

Now it’s your turn…

Let’s get you into your new home now.

Get pre-approved for your new home today.

You May Also Like...

Buying a Home vs Renting in Colorado

Buying vs Renting in DenverBuying vs. renting in Denver. Is owning a home...

FHA Loans in Colorado: Unlocking the Path to Homeownership

FHA Loans in Colorado: Unlocking the Path to HomeownershipHere’s why FHA...

How to Buy a Home in Colorado

How to Buy a Home in ColoradoDeciding to buy a home is exciting and...